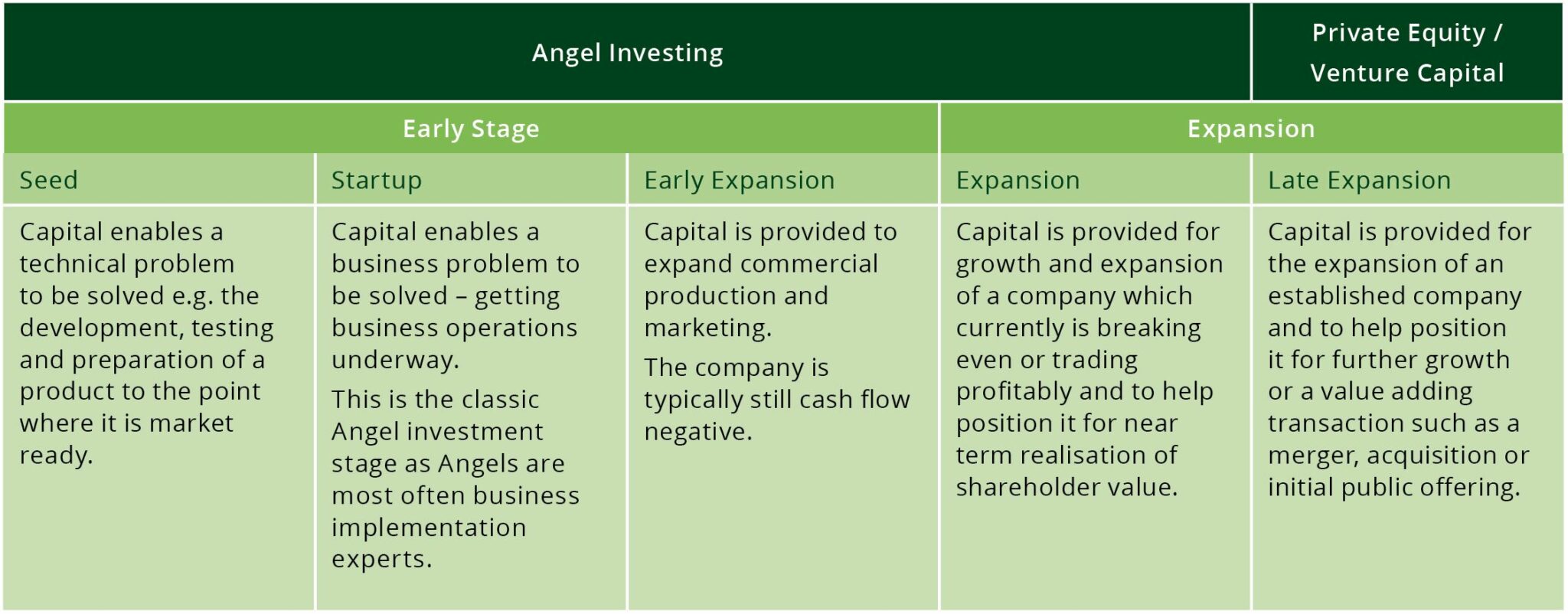

Early-stage investing funds the first three stages of a company’s development. It is divided into three distinct funding types:

Seed funding (seed capital)

- Money provided to help an entrepreneur start a business

Seed-stage companies have not usually established commercial operations – financing continues supports pre-startup R&D, product development and testing, or designing specialized equipment.

Investors at the seed-stage will typically participate in later investment rounds with other investors to finance business expansion costs such as sales and distribution, parts and inventory, hiring, training and marketing.

Start-up funding

- money used to help a company develop products and start marketing those products

Start-up companies are the most common stage for angels to invest. The company is able to begin operations but is not yet at the stage of commercial manufacturing and sales. These companies have retained key management, prepared a business plan and undertaken market validations. At this stage, the business is seeing its first revenues but has yet to show a profit. Financing supports product development and initial marketing.

Early-growth funding

- money to help establish and boost manufacturing and sales

Early Expansion companies require capital to initiate commercial manufacturing and sales. Most of these companies have been in business less than three years and have a product or service in testing or pilot production. In some cases, the product may be commercially available.

Stages of Capital Investment

Early-stage investors understand that building a new business takes time and ongoing support, so they typically expect to make multiple investments in a single company as it develops.

Angel investors are invaluable in these early stages as they are able to offer expertise, experience and contacts in addition to capital.

Since launching in 2008, Enterprise Angels has facilitated the investment of over $65m in more than 100 different early stage and established businesses across a variety of industry sectors: agtech, technology, hardware and equipment, software and services, food and beverage and medical-human.

If you are interested in finding out more about angel investing, subscribe to our quarterly newsletter to receive our investment guides, request invitations to our pitch events or get in contact with the team.

Get in touch!

We welcome engagement from anyone interested or involved in the early stage investment market – Investors, Angel Members, Strategic or Corporate Partners, Founders, Incubators or Accelerators, Deal Referrers, Acquisition Partners etc.