After 10 years of angel investing, it’s interesting to see the outcomes of our investments and number of companies that are thriving. This information gives investors a better sense for likely returns and strategies to achieve them. The number of angel successes and investee companies that are thriving is promising, but ‘investor beware’, angel investing is high risk – there are no two ways about it.

Portfolio overview

Enterprise Angels members have been investing for over 10 years. EA Fund 1 for four years and EA Fund 2 for two. Overall we’ve invested in 80 companies and had 21 exits. 11 companies provided positive investment returns and 10 negative returns. The existing portfolio is looking quite impressive with a number of ‘thoroughbreds’. These thoroughbreds are making a name for themselves the world over (about 18% of the portfolio are thriving).

We do have a few ‘zombies’ (about 13% of the portfolio) – yes, that is a commonly used term for portfolio companies that just don’t die, yet don’t achieve anything!

The majority of the companies are still in high-growth mode (39% of the portfolio).

Successes

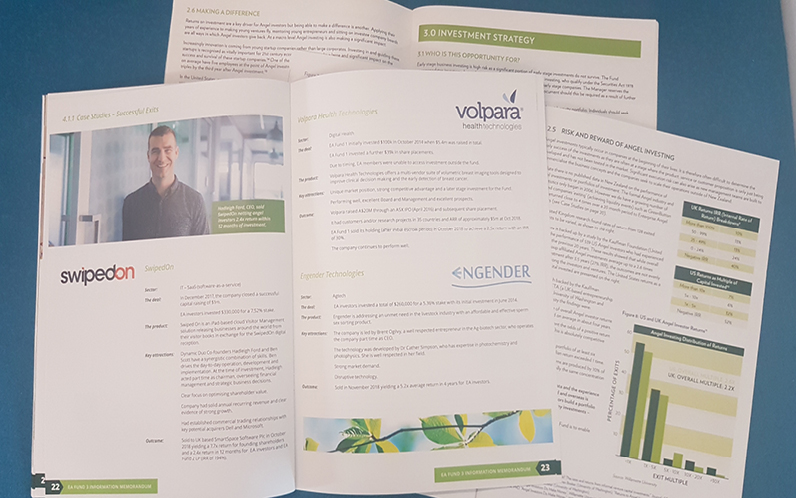

Recent successes include companies such as Engender, which returned 5.2 times investment in five years, Volpara, which returned 2.5x in four years, and SwipedOn, which returned 2.4 times in less than 12 months.

Of the remaining successful portfolio companies, there are a number that have attracted significant further investment from later stage investors like venture capital and private equity firms. Understanding where and who the next stage funders are for our companies is a critical part of the equation. Companies need more than angel money to be globally successful. EA portfolio companies that have successfully secured such investors include Merlot Aero (recently raised $2m and received award for being most innovative airline operations software company), Fuel50, Parrot Analytics (currently completing a $12m round) and Heilala Vanilla ($1.5m).

Learnings

It’s still early days for the Angel investing industry in New Zealand. However the results appear to be telling us that compared to US Angel investing (where we’ve traditionally drawn our statistical information), we are having fewer negative returns but also fewer high-multiple returns (>10 times). US Angel statistics show an average of 7 out of 10 investments provide negative returns. Typically only one or two investments return greater than 10 times.

Whether looking at US or NZ return statistics, the fundamental strategy is to diversify and invest in a minimum of 10 companies. For all but the most wealthy, the most efficient way to achieve this is by investing in a Fund. If this is something that appeals to you, register interest for EA Fund 4, which is launching later this year – find out more here.