EA FUND 4 - AN OPPORTUNITY TO INVEST IN A DIVERSIFIED PORTFOLIO OF KIWI STARTUPS - CLICK HERE

About Enterprise Angels

Meet the team, committees, board and understand what we do.

Enterprise Angels is a membership-based investment network and a wider community of nationwide wholesale investors. Our objective is to connect experienced early stage investors with entrepreneurs and innovators.

We believe that growing innovative, socially and environmentally responsible companies is the key to ensuring people, communities, businesses, the environment, and the economy thrive.

Enterprise Angels was formed in 2008. Since that time Enterprise Angels has evolved into one of the largest, most active and best resourced Angel groups in the country with over 200 members, who have a wide range of expertise.

Enterprise Angels is a unique model of early stage investing in New Zealand having a full-time team and a deep collection of qualified investors to assist entrepreneurs in obtaining the resources they need – funds as well as skills, expertise and connections. We regard this as a ‘best practice’ model for investing in early stage companies – an efficient capital raising process for entrepreneurs and investors adding real value as well as capital to investee companies.

Enterprise Angels is a member of the Angel Association of New Zealand (AANZ), a network of more than a dozen angel groups and funds throughout the country. We promote and facilitate investor education by providing education events, active learning opportunities on actual deals and best practice procedures.

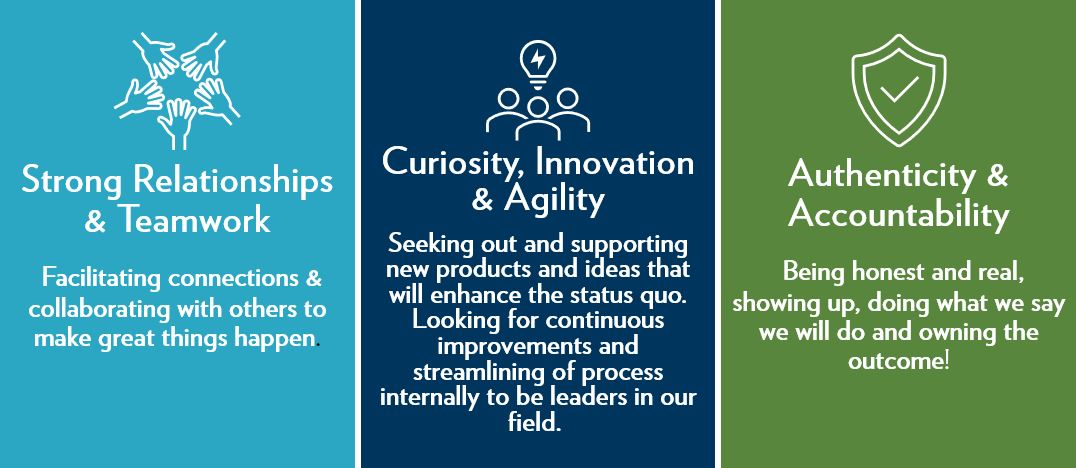

Key Values

Contact us

Please enter your contact details below, and we will be in touch.

Our Team

The Enterprise Angels team are passionate about growing innovative companies. As experienced finance professionals, they have been working together facilitating funding for unique and scalable companies since 2008.

Our Board

An incorporated society, Enterprise Angels was established in 2008 and is governed by a Board of Directors elected by its members.

Our Investment Committee

The Investment Committee:

- Screens investment opportunities to pitch and/or go into due diligence for fund investment consideration. It considers:

-

-

-

- Fund mandate

- Key criteria (people, moat, timing, market size, idea with exponential benefit, NZ based/global ambitions)

- Whether the opportunity will appeal to the membership (for pitching)

-

-

- Receives recommendations from Enterprise Angels following due diligence on investment opportunities and decide whether the fund will invest. The Investment Committee does not undertake due diligence in the normal course of a fund investment, as it relies on Enterprise Angels to drive investment terms and due diligence processes.

- Considers and determines holding valuations for fund companies based on information received from Enterprise Angels.

All decisions of the Investment Committee must be ratified by the EA GP Board.

Our Exit Committee

Our Exit Committee specifically focuses on the more mature portfolio companies and how they can realise returns for founders and early investors – exits in the form of IPO, trade sale or post angel funding. The committee, comprises of exited entrepreneurs and experienced angels.