Capital Raising

Find out how to get started, what value we add, what we are looking for, how to apply and how the process works.

Why raise with us?

You only need to provide us with a summary of your offer – preferably using or at least including the information detailed in our Dropsheet Template to get the ball rolling.

We’ll be in touch if we believe your opportunity will appeal to our investors and guide you every step of the way.

Our angel investors are predominantly located in the Bay of Plenty and the Waikato, however in addition we have an extensive nationwide database of wholesale investors who are interested in investing in innovative early stage companies.

The skills and experience of angel investors can make all the difference to whether a young company thrives or fails.

With a crowd of Enterprise Angels investors, you will gain access to a broad range of skills, expertise and contacts.

Only experienced and wealthy (Wholesale) investors can invest in your business through Enterprise Angels with a minimum investment of $10K per company.

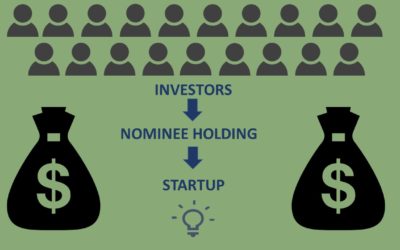

All investors will invest via our nominee structure unless otherwise agreed with you and the resultant smaller share register that will resonate better with Venture Capitalists and other later stage funders.

What do we invest in?

Capable and aspirational founders who understand the value of and want angel investors

Potential to scale internationally

Companies based in New Zealand

How to raise capital with us?

Before you raise capital, you need to be investment ready

Enterprise Angels offers Angelic Drop In clinics where you can speak one on one with experienced angels to help you become Investment Ready.

Step 1 : Team review & screening committee

If your opportunity is something we feel our members will invest in, we will be in touch to talk about how we can get you in front of our screening committee to evaluate if it would be worth your while pitching to our investors.

Step 2 : Pitch to members and invited guest investors

We provide guidance on the process. You will pitch to Tauranga and Hamilton audiences and your pitch will be videoed in order to offer to our wider wholesale investor database.

Step 3: Due diligence & deal development

Members with specific experience will undertake due diligence on your opportunity and present the findings at a meeting and in a final report. Due diligence will help inform terms including investor protective provisions. We have template term sheets and investment documentation to streamline this process.

Step 4 : Investment

Your offer will initially be made to Angel Investors, then if it gets traction to NZGCP (formerly NZVIF), our current Fund, and then out to other angel groups and wholesale investors nationwide.

Step 5 : Settlement

We work with your lawyers to prepare necessary documentation, collect funds and compliance information from investors, and pay funds on to you.

Ready to get started?

Useful Guides

Thriving on a Shoestring: Low-Budget Marketing Tips for Startups

Launching a startup is an exhilarating journey, but tight budgets can often be a stumbling block, especially when it comes to marketing efforts. The good news is that a limited budget doesn't mean compromising on creativity or effectiveness. Here are some practical,...

Maintaining positive mental wellbeing

In the current environment with economic uncertainty, rising costs and labour shortages, it can be difficult at times to remain optimistic. Maintaining positive mental well-being is essential for overall health and quality of life. It not only benefits individuals...

Navigating Year-End Success: A Guide for Startup Owners

As the calendar flips to its final pages, startup business owners find themselves at a crucial juncture—one that demands reflection, strategic planning, and preparation for the challenges and opportunities that the new year may bring. Year-end considerations are not...

R & D Tax Incentive

Since its enactment in June 2019, the R&D (research and development) tax credit scheme is currently in its fourth year of running (with application from the 2020 income year). The scheme provides a 15% credit on your R&D costs and can be applied by a company...

The Capital Raising Process – what’s involved.

Gaining investment is crucial to the growth of your business, therefore you want to ensure that you are prepared. As a first step we recommend you book in at an Angelic Drop in clinic for general help in preparing for capital raising, You’ll spend an invaluable 20...

Who pays the fees in early-stage investing?

Whether you’re investing via a Venture Capital Fund (VC), an Angel group nominee or directly into a startup, resourcing is required for deal making and post investment management: undertaking due diligence, facilitating the investment, supporting the startup,...

Elements of an Efficient Capital Raise

Our recent capital raise with SquareOne was achieved in six weeks from initial contact through to settlement of funds. During this time, working closely with SquareOne, we reviewed investment material, organized an opportunity to Pitch to our members, undertook due...

Key ingredients to a successful pitch.

Firstly, it is important to understand why you are pitching. It is not, as is often assumed, to get investors to open their chequebook. The pitch’s purpose is to get sufficient demand from the audience for a follow-on conversation. Your goal is to create curiosity,...

Pitch Night – What is it all about?

The purpose of Pitch Night is to introduce investment ready businesses to our membership as prospective investment opportunities. These early-stage companies could be existing Enterprise Angels portfolio companies returning for further investment, or new opportunities...

What is a nominee holding company?

Both angel groups and Venture Capital (VC) funds use nominee companies. Angel groups use them for most investments and VCs sometimes use them for co-investment opportunities for Limited Partners. Nominees provide a great deal of value to both investors and investee...