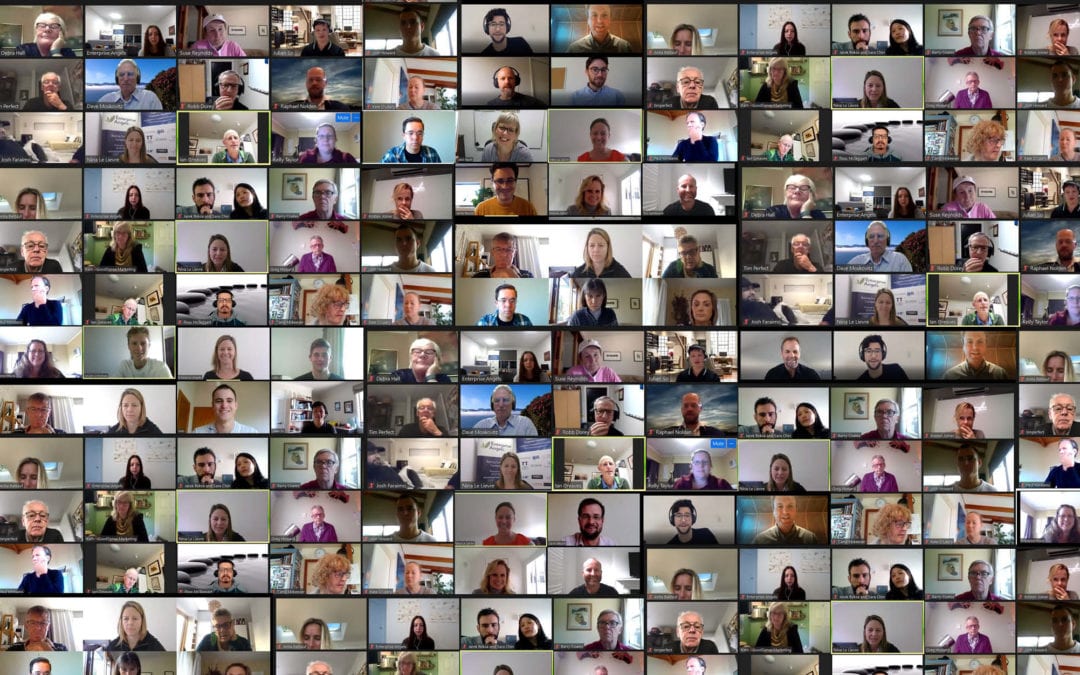

So many screens and faces but how much human connection is really going on? When New Zealand moved into lock down due to the COVID-19 pandemic, like many other organisations we held our events and meetings online and continued to do this until there was minimal risk to the health of our community of members and investors.

We have always provided pitch videos to our investors, post any investment event, and the resulting investment from this medium, vs the investment from those that attend the pitch night and meet the founders, is always significantly lower. However, when investing in a company and founder that investors already know, a virtual meeting can also have good outcomes; that human connection is already in place. I think this will drive behaviour for the new norm across businesses – in person meetings for starting relationships and virtual where possible where there is an established relationship.

Feedback from investors on our April pitch webinar was that the medium (Zoom) was effective and the key note speaker and quality of the pitching companies was good (Steve Saunders spoke on the Robotics Plus journey with Yabble and Marama Labs pitching). The thing our community really missed was the networking and face-to-face time with the founders. Given what we know about angel investing, the very absence of meeting the founders likely resulted in lower than usual interest in actual investing. To be fair, it was an uncertain time (beginning of April) to be bringing out the cheque book so the outcomes of our June pitch night have been more revealing.

In June, New Zealand was in a fairly good place, markets had improved with the announcement that we were moving to Level 1. Attendance at our June pitch webinar wasn’t as high as it was when we were all in lock down (no surprises there, we had a captive audience), but it was about the same as a typical ‘in person’ pitch night. We also provided breakout rooms for each of the companies which both attracted a dozen or so investors to ‘meet’ with the founders. The engagement of members with these new opportunities more than doubled since our April event – with both pitching companies receiving new investment support. This result is likely due to a combination of things – the human connection enabled by the smaller breakout rooms, as well as the change in investor sentiment.

Angel investing has a real human element to it and this new virtual world needs to be adapted somewhat to create and foster that connection. The key success factor in any angel investment is the founder and the people they bring on the journey with them.

There are many fallacies about angel investors and startups. It’s not like a fairy tale with an angel to take all your money troubles away. There are no overnight successes. It’s a true hard slog and if you pick the right investor, they can be there to help you and your team through the tough times. It may be a connection, it may be experience and expertise, or it may simply be moral support and a friendly ear to sound out ideas.

Here are some interesting observations from my experience:

- Angels invest predominantly in people and want to make a connection with founders.

- Founders are exceptional people with the ability to walk through walls and find hidden doors.

- Alignment between founders and investors is critical in a successful investment. You’re on the same journey but perhaps different vehicles (the investor might be in an Audi and the founder in a Toyota Corolla…).

When looking at startups and the problems they’re solving, we see the resilience and innovation of our founders, many are solving efficiency problems and will thrive in the current situation, others are innovating and leveraging what they have:

- Heilala Vanilla (Jennifer Boggiss) has repurposed some of its vanilla tanks to make hand sanitiser. Check out their website for free shipping NZ wide.

- Spoke Phone (Jason Kerr) is ideal for the remote workforce, its technology turns personal mobile phones into part of a business network in minutes.

- Beany (Sue De Bievre) – small business accounting – fully online!

- Firstcheck (Hayden Laird) – remote skin checks from the comfort of your own home, reducing the need for doctor’s visits.

- Fuel50 (Anne Fulton and Jo Mills) – talent experience platform where powerful AI gives employees smart-matches to internal career opportunities, redeployment opportunities and gig assignments based on their skills and talents, whilst giving HR powerful workforce data to make strategic business decisions. Fuel50 deployed a product, FuelFuturesTM, to help solve outplacement and redundancies during the current environment where reskilling, restructuring, and retrenchment are impacting businesses.

- Inhibit Coatings (Eldon Tate) – exploring antiviral properties of silver nanoparticles it uses in its antibacterial coatings.

- Insite AI (Shaveer Mirpuri) – demand forecasting is even more important in this current environment, particularly with food (one of its first customers, Tyson Foods).

- Yabble (Rachel O’Shea and Kathryn Topp) – an ethical digital data insights platform that gives real-time customer feedback to businesses. Customers earn rewards for completing surveys and with customer sentiment rapidly changing in the current environment, brands are in some instances quintupling the amount of their customer sentiment analysis.

This names but a few… obviously there are some of our portfolio companies that will struggle because of social distancing, like those in the tourism industry – they will need to hunker down, preserve cash and hopefully re–emerge when life gets back to ‘normal’. The founders of these companies have been quick to move and enact such changes.

While we don’t know what the new normal is going to look like, we do know that life goes on, and we will always need efficiencies. Change makes innovation essential and that is one thing we know a lot about – innovation. That’s why we’re here!

We are looking forward to our July pitch night and AGM on 28 July where we will be bringing our community physically together again. Find out more and register to attend here. Don’t worry, we will continue to offer virtual access to our investors and partners throughout the country, whether you are outside of Tauranga and Hamilton or are at home with a cold, simply note your preference to attend remotely on the form.