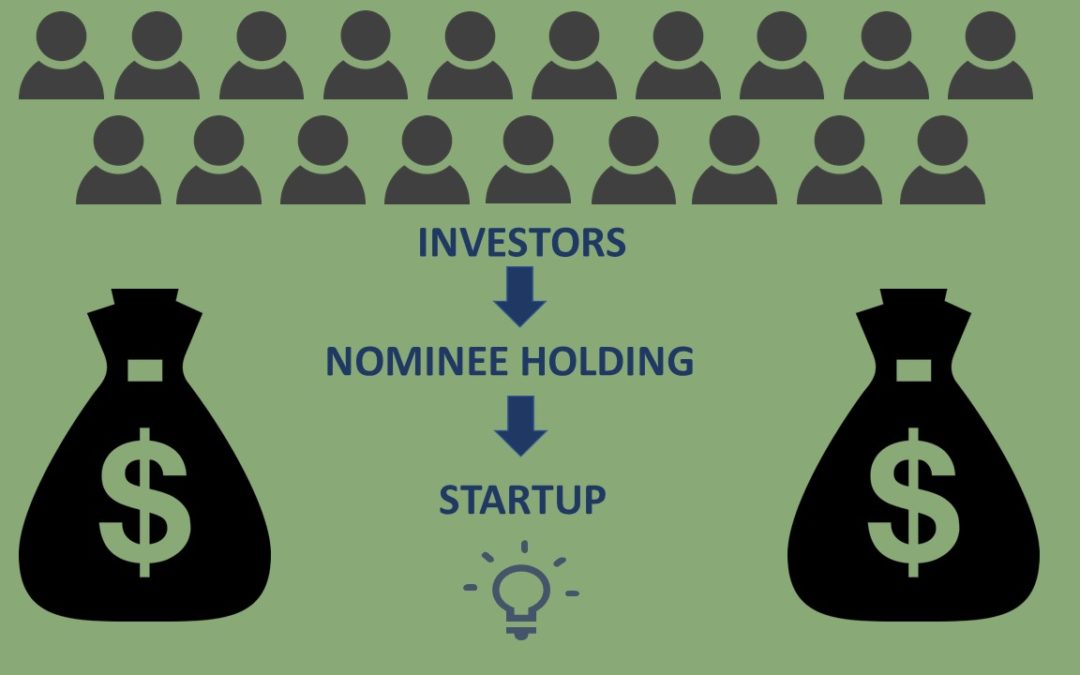

Both angel groups and Venture Capital (VC) funds use nominee companies. Angel groups use them for most investments and VCs sometimes use them for co-investment opportunities for Limited Partners. Nominees provide a great deal of value to both investors and investee companies.

Value to investee companies

The goal of startups is to grow and mature and have a huge impact on the industry they are disrupting. In doing so they have the potential to provide exponential returns to their investors. It’s a hard road though – high risk but high reward – failure is more common than success and in order to succeed, startups need capital and access to expertise and connections. Angels are a good source of all three in the formative years of a startup.

In New Zealand, angels typically invest parcel sizes ranging from about $10k to $50k. Your average startup will likely need to raise at least $500k at its angel stage capital raise. Angel networks group their investors into a nominee investing entity to simplify the cap table and investor communications for the company. This means that there is one investing entity on the share register and underlying that are the individual angel investors.

Managing many individual shareholders is cumbersome to a lean startup and is not where they should be spending their time. This management entails liaising with all shareholders for shareholder updates and approvals/voting on corporate actions (e.g. accepting financial statements for the year, changes to the constitution and shareholders agreement) and responding to all such shareholders. Having a nominee holding on the share register means that companies can simplify their shareholder communications. They only need to deal with the representative of the nominee yet can leverage the wider group of underlying investors as required.

Next stage investors, typically in the form of a VC fund, want to see product market fit, but there are a few practical matters that must also be taken care of – housekeeping. A tidy cap table with few shareholders and a founder with a good % shareholding in the company are often key criteria.

- An extensive shareholding can lead to complications including difficulty in managing numerous shareholders and triggering the company to become a Code Company under The Takeover Code

- A severely diluted founder is less incentivised to drive the exponential growth of the company.

Value to investors

Investors can spread their risk and invest smaller parcels across a range of start-ups. They do not have to sign documents but can simply respond by email for corporate actions and other investment documentation (the nominee signs on behalf of underlying investors). Other benefits include:

- Enterprise Angels forwards shareholder communications to investors in relation to their investee companies.

- Enterprise Angels provides 6 monthly reporting detailing all investment transactions and holdings via EA Nominee Limited.

- Enhanced Investor Rights: As a bare nominee each investor generally maintains the same rights that they would as a direct shareholder, although for operational efficiency, investors appoint Enterprise Angels to exercise rights on its behalf. Aggregation via the nominee can augment this with additional rights such as:

- Retaining information and pre-emptive rights for longer (later VC rounds often mean smaller shareholders with <5% shareholding lose such rights)

- Oversubscription Opportunities: Greater chance of accessing larger allocations in follow on investment rounds than if you are a direct shareholder. The nominee is allocated its pre-emptive rights based on the consolidated holdings of the underlying investors and often not all investors in the nominee subscribe for their full entitlement which means their entitlement can be subscribed for by other investors within the nominee.

- Board Representation: investee companies typically give board appointment rights or board observer rights to large, strategic or “lead” investors. By aggregating our holding the likelihood of negotiating such representation is greatly increased. Even if board representation is not achieved, investing in a group of aligned investors means the nominee can advocate as a collective on behalf of all individuals.

- Investor Privacy: Using a nominee means that underlying shareholder information is not publicly available on Companies Office which provides greater privacy to investors and investee companies if required.

- Corporate action efficiency: By appointing the nominee to act as power of attorney, on behalf of underlying investors, Enterprise Angels can execute time-sensitive documents where investors (or directors and trustees) may not be able to respond in a timely manner, or do not have access to internet or facilities to print, sign or scan documents.

- Smaller shareholders are often forced to be combined under a nominee company in later rounds anyway.

Cost of running the nominee

Over the course of the year, running the nominee, which manages 330 investors across 63 companies with $50M AUM (assets under management), takes about 1500 staff hours which includes corporate actions (chasing responses, answering investor questions), payment and share reconciliations, ongoing investor compliance, AGM attendance, circulating company updates, settling investments, liaising with companies, reporting to investors, reporting to regulators, governance of nominee (noting that directors’ time is additional and voluntary) and preparation for and undertaking the annual custodian audit. In addition, there are $ costs such as the auditor’s annual fee, Xero subscription costs and D&O and professional liability insurance (totalling approximately $15k).

The cost of operating EA Nominee is covered by a combination of Enterprise Angels membership fees, the investee company (either by payment of a transaction fee at the time of investment or by a monthly or annual subscription) or the investor (by an administration fee at time of investment). In all instances, any fees are communicated to the investor/investee before any commitments to invest are formalised.

We pride ourselves on providing a professional nominee service and to continue to do this as our portfolio grows and matures, we recently upgraded our deal management system to a more scalable and streamlined system, Syndex. It is built on Salesforce and has robust security, powerful reporting tools and business rules in place to ensure compliance and reduce manual checking. This will drive efficiencies as the number of portfolio companies grows and will provide investors with an investor portal to manage and view their holdings 24/7. It will also enable us to offer admin and compliance services to other nominees, angel groups and funds and further diversify our revenue.

To find out more about EA Nominee, click here. If you have any feedback on our nominee, please contact us here.

Get in touch!

We welcome engagement from anyone interested or involved in the early stage investment market – Investors, Angel Members, Strategic or Corporate Partners, Founders, Incubators or Accelerators, Deal Referrers, Acquisition Partners etc.