It’s been another rollercoaster twelve months with some highs; having great attendance at in-person events again, some significant milestones achieved by our portfolio companies, and some lows; rapidly changing economic conditions, and adverse weather events.

Portfolio review

Over the financial year Enterprise Angels has facilitated investments in eight new start-ups and 31 existing portfolio companies, totaling $4.8m (down on last year’s total of $9.3m). We have distributed $800K to investors, predominantly from one deal (not surprising in the current climate that it is significantly down on last year’s distributions of $4.9m).

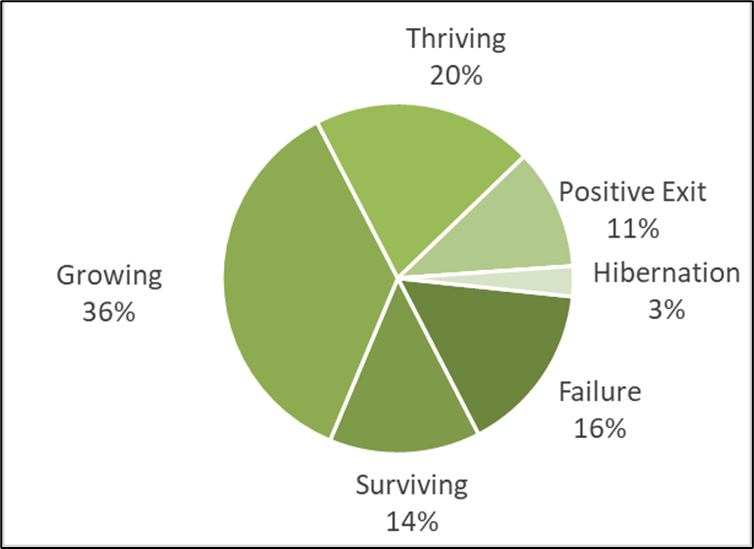

Our total facilitated investment since inception is now over $65m into 110 New Zealand startups across a variety of industries, supporting over 1600 jobs. Every year we review the status of our portfolio companies based on their performance. There has not been a lot of change over the last 12 months which is encouraging given the tougher economic conditions.

Status of portfolio companies (April 2023)

Membership

We have welcomed 23 new members from all around New Zealand and as far afield as Canada and India. This is in large part due to referrals made by existing members who want to share the positive experience they have with our group. Every new member increases the depth and breadth of our pool of expertise, experience and investment dollars making Enterprise Angels a strong force for economic growth.

In total we have 125 Bay of Plenty members, 53 Waikato members, 22 members throughout NZ and 5 overseas members. And we have a super supportive group of 20 Strategic and Corporate Partners. It takes a country to raise a startup and we are super proud of the commitment of the community we have at Enterprise Angels.

In September we welcomed Jenny Rudd and Matt McHardy to our board, joining a great team of people providing governance and guidance.

We also recognised the great work of our most active members with our Annual Angel Awards:

- New Member of the Year sponsored by Priority One – Nik Burfoot

- Investor Rep/Director of the Year sponsored by Syndex – Hadleigh Ford

- Angel of the Year – Tauranga sponsored by Cooney Lees Morgan – Andrew Knowles

As we refined the processes for our newly launched fund, EA Fund 4, we merged our screening and investment committees together forming our new Investment Committee. This committee is responsible for screening opportunities to go to pitch night for member events and/or to be taken into the due diligence phase for EA Fund 4. It also makes investment recommendations for the EA Funds.

Continuous improvement

We have made huge progress on initiatives to ensure the sustainability of Enterprise Angels and our competitiveness in the ecosystem. In August we launched our investor portal via Syndex, leveraging our strategic partnership with them. We are reaping the benefits of the automation and streamlining of the deal management process and will be rolling out further functionality over the coming year to enable continuous peer-to-peer trading and real-time periodic trading. Liquidity is one of the challenging aspects of angel investing which this functionality will help ease.

Our Member and Founder Support Directories were also released, enabling members and portfolio company founders to search for expertise and make direct contact with one another. Alongside this there has been substantial work by the team in back-end processes to ensure better onboarding and member engagement experiences.

EA Fund 4

With EA Fund 1, 2 and 3 now fully invested, we launched EA Fund 4 to our members, Limited Partners and close contacts towards the end of the calendar year. It is now almost at the $2m first close target. As we extend the offer to be involved in EA Fund 4 to a wider audience, we look forward to attracting new investors. The fund’s target size is $4-6m with a cap of $10m. At the upper limit, the fund will invest in up to 35 innovative companies, capitalising both on our experience and learnings, as well as the ability to cherry pick deals from our existing portfolio. Find out more about EA Fund 4 here.

After a busy, productive year, we are in a good position to meet the challenges of the current economic uncertainty and support founders solving gnarly problems! The one thing that is certain is that there are plenty of problems to be solved and we know from experience that founders are the ones that have the tenacity, agility and passion to solve these problems.