Blog

Latest news, events and updates from Enterprise Angels, our partners and portfolio companies.

If you are keen to keep up to date with our news, subscribe to our quarterly newsletter or you can also choose to recieve event invites and select deal opportunities.

Stages of Venture Capital

Early-stage investing funds the first three stages of a company’s development. It is divided into three distinct funding types: Seed funding (seed capital) Money provided to help an entrepreneur start a business Seed-stage companies have not usually established...

The Capital Raising Process – what’s involved.

Gaining investment is crucial to the growth of your business, therefore you want to ensure that you are prepared. As a first step we recommend you book in at an Angelic Drop in clinic for general help in preparing for capital raising, You’ll spend an invaluable 20...

Who pays the fees in early-stage investing?

Whether you’re investing via a Venture Capital Fund (VC), an Angel group nominee or directly into a startup, resourcing is required for deal making and post investment management: undertaking due diligence, facilitating the investment, supporting the startup,...

Elements of an Efficient Capital Raise

Our recent capital raise with SquareOne was achieved in six weeks from initial contact through to settlement of funds. During this time, working closely with SquareOne, we reviewed investment material, organized an opportunity to Pitch to our members, undertook due...

Key ingredients to a successful pitch.

Firstly, it is important to understand why you are pitching. It is not, as is often assumed, to get investors to open their chequebook. The pitch’s purpose is to get sufficient demand from the audience for a follow-on conversation. Your goal is to create curiosity,...

Pitch Night – What is it all about?

The purpose of Pitch Night is to introduce investment ready businesses to our membership as prospective investment opportunities. These early-stage companies could be existing Enterprise Angels portfolio companies returning for further investment, or new opportunities...

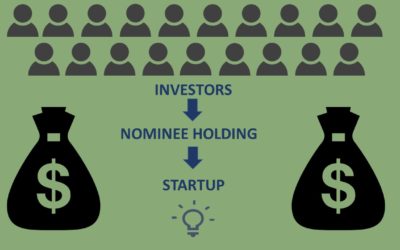

What is a nominee holding company?

Both angel groups and Venture Capital (VC) funds use nominee companies. Angel groups use them for most investments and VCs sometimes use them for co-investment opportunities for Limited Partners. Nominees provide a great deal of value to both investors and investee...

Angel Awards 2021

Recently Enterprise Angels celebrated its Annual Angel Awards; an opportunity to acknowledge members who have made a significant contribution to the network in terms of time, capital, and assistance during the 2020/21 financial year. Angel investing is more than just...

Investor Reps: Want to really help an early stage company?

Angel Members have the opportunity to put their experience, skills and connections to work by taking on the role of an Investor Director or Investor Representative in one of the companies they invest in. Being an Investor Rep is a fantastic role which aims to maximise...

Employer of Choice

The world of work is changing rapidly, and attracting people with the right skills and experience is proving a challenge in our region and beyond. Therefore, it's never been more important for businesses to stand out as an ‘employer of choice’ to attract and retain...