After 15 years of angel investing, it’s interesting to see the outcomes of our investments, the number of companies that have failed and the number of companies that are thriving. This information gives investors a better sense for likely returns and strategies to achieve them. The number of angel successes and investee companies that are thriving is promising, but ‘investor beware’, angel investing is high risk – there are no two ways about it.

Portfolio overview

Overall we’ve invested in 106 companies and had 32 exits. 15 companies have provided positive investment returns – 12 of these were acquired or listed. There have been 17 negative returns.

The existing portfolio is looking quite impressive with a number of ‘thoroughbreds’. (We love thoroughbreds because they are not mythical creatures like Unicorns!) These thoroughbreds are making a name for themselves the world over (about 18% of the portfolio are thriving) including Fuel50, Spoke, Parrot Analytics, Lawvu, and Datagate Innovation.

We do have a few ‘zombies’ (about 11% of the portfolio) – yes, that is a commonly used term for portfolio companies that struggle to achieve scale and sometimes become slow growth lifestyle companies!

The majority of the companies are still in high-growth mode (47% of the portfolio).

Successes

Recent successes include companies such as Moxion, which returned 5x investment in under five years, Merlot Aero, which returned 2.6x in five years, and back in 2018 there was local company SwipedOn, which returned 2.4x in less than 12 months.

Of the remaining successful portfolio companies, there are a number that have attracted significant further investment from later stage investors like venture capital and private equity firms. Understanding where and who the next stage funders are for our companies is a critical part of the equation. Companies need more than angel money to be globally successful. Many Enterprise Angels portfolio companies have successfully secured such investors including Fuel50, UBCO and Heilala Vanilla.

Economic Effects

We’ve been asked many times over the years what happened to Angel Investing during an economic downturn. Everyone (Angels, entrepreneurs, market commentators, the man on the street) expected the answer to be that Angel investors held their breath, pinched their pockets, turned in their wings and stopped investing. Makes sense – most people will hold onto what they have and not take on risk in periods of great uncertainty.

However if we look back to the GFC, and our experience over the last two years Angel investors here and in the US kept on investing. There are several thoughts on this:

- Angel money is most often ‘already earned and put away’ money. Therefore it tends to not be as affected by financial or economic crises.

- Angels can afford to lose the money they have set aside for Angel investments. So it is money intended to be used in high risk companies/situations.

- Angels know these high risk companies are led by entrepreneurs very used to working in uncertain and stressful situations and not only finding ways through them but ‘pivoting’ to exploit opportunities that arise from a changing environment.

- Despite the challenges over the last few years: Covid, global supply chain issues, employment constraints and high inflation, many Angels are surprised at how well most of their companies are doing. Investee companies have adapted throughout these challenges with some reigning in expenditure and targeting profitability (vs growth at all costs), some continue to thrive, but of course there have been a few that have seriously struggled. If a company is struggling, tough economic times amplify the impact!

So given the very nature of Angel investors and investing it seems unlikely we’ll see a long term decrease in investment activity. Indeed many angels have realised there are some very exciting opportunities available as companies adjust capital raising expectations to meet the market.

Already we have seen hyped up valuations being eroded, leading to good value buying opportunities into well performing companies at prices that could only be dreamed of 12 months ago. Warren Buffet, American business magnate and one of the world’s most successful investors, said, “Widespread fear is your friend as an investor because it serves up bargain purchases.”

Learnings

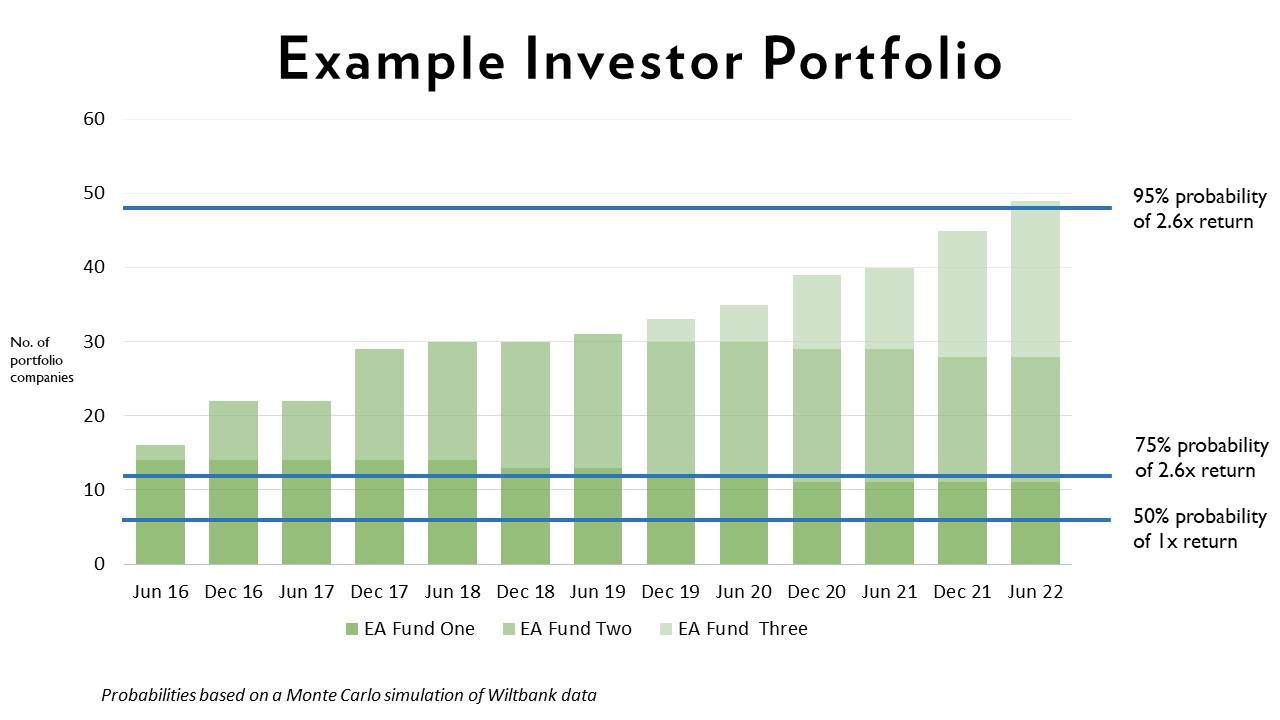

Understanding the highs and lows of an angel portfolio points to the obvious fundamental strategy of diversification. The more you diversify the greater your chance is of high returns as depicted in the graph below.

For all but the most wealthy, the most efficient way to achieve this is by investing in a Fund.

We are excited to have launched EA Fund 4, which has a target of investing in up to 35 different companies. EA Fund 4 offers investors the opportunity to put their trust in proven fund managers, diversify your portfolio in this exciting asset class and be part of growing some of NZ’s most innovative companies.

Get in touch!

We welcome engagement from anyone interested or involved in the early stage investment market – Investors, Angel Members, Strategic or Corporate Partners, Founders, Incubators or Accelerators, Deal Referrers, Acquisition Partners etc.