New Member Information

We are thrilled to have you on board as a member.

Angel investing is not just about providing capital to start-up companies, it is also about assisting entrepreneurs with skills, expertise, and connections. The more involved you become in supporting early stage companies the greater the opportunity to increase your knowledge by learning from the experience of those you are working alongside.

You may like a member mentor or buddy to introduce you to Angel Investing, if so request on the button below.

The Enteprise Angels Team

Enterprise Angels was established in 2008 by Bill Murphy, since then our 200+ members, funds and wholesale investor community have collectively invested almost $70m dollars in over 100 new start ups.

It is an incorporated society governed by a Board of Directors elected by members. Click here to view the current Board.

We’re a friendly bunch and keen to make sure you make the most of your membership. To find out more about the team and our roles click here.

Please reach out in regard to any questions you may have.

Enterprise Angels Portfolio

Enterprise Angels has now invested in over 100 NZ startups. See current portfolio companies here. Most of the portfolio companies are software, hardware or agtech, with the majority being based in Auckland, Bay of Plenty and Wellington . A good number of our startups now have a strong international presence with global corporates as clients – Fuel50 and Parrot Analytics to name a couple.

In terms of stage of companies at the time we invest, the majority is at the start-up stage. However in terms of the amount of capital invested, almost 50% is at the early expansion stage, meaning we tend to double down as our companies prove their value proposition and start to see product market fit – the risk at this stage is considerably reduced. In fact, we have invested in over 170 follow-on investment rounds. Sometimes these rounds are exclusively for existing investors but often the amount of capital the companies are seeking is greater than existing investors can support so there can be an opportunity for new investors to get onboard.

While financial inputs are extremely important, the other less visible inputs are equally important – active angel members have supported these businesses in numerous ways through utilising their experience, skills, and connections.

Our Partner Network

Very important to Enterprise Angels are the 20 plus high quality partners who support us in our work with early stage companies. You can see who they are here.

If you are in need of professional services please contact them – don’t forget to mention us when you make contact.

We are truly grateful to our partners, as they enable us to provide the services we offer.

Member Directory

As a new member it can be hard introducing yourself to others at events, so let us take some of the pressure off by sharing your profile with our member community via our member directory.

Member profiles are a great way to let others know who you are, what you do and your skills and experience. Then when looking for someone with your skill set they won’t hesitate to make that all-important introduction.

The directory is also a great way for you to find out more about and engage with our existing members and partners.

Update your profile. (Please note to access this area you will have needed to activate your account. Instructions were sent out in an email last week but please get in touch if you are having trouble)

Founder Support Directory

One of the strengths of Enterprise Angels is the commitment of our members volunteering time and providing resources to support the early-stage ecosystem. To enable our portfolio companies to capitalise on this we have created a Founder Support Directory. This directory is a place to go to for our Founder and Investor reps to go to when seeking help with expertise and connections.

If you have already indicated you are willing to help or mentor founders, you will automatically have been added to the Founder Support Directory. To be added, simply click add a listing under Directory Listings in your member profile.

Communications

Email is our main form of communication. The type of communication you will receive from us include:

- Deal opportunities

- Event Invites

- Monthly newsletter updates

- Investment reports

- Corporate Actions

- Settlement Emails

In addition to individual team members’ names, key email addresses are:

- investment_team@enterpriseangels.co.nz – for investment commitments, corporate actions and company updates

- compliance_team@enterpriseangels.co.nz – for investor onboarding, customer due diligence, tax and account information updates

- admin@enterpriseangels.co.nz – membership and other general enquiries

We want to make sure our emails make it to your inbox. If you haven’t already done so please add us as a contact or put our email domain @enterpriseangels.co.nz on your whitelist. Whitelisting an email involves telling your email provider that you want emails from that sender to be allowed into your inbox rather than being filtered into spam.

Click here for instructions on how to whitelist an email.

Email security

We take cyber security seriously and deal with sensitive information and large payments so please be aware of any phishing emails that look suspicious for example changing payment instructions.

Always check account details for payment requests, and make sure it is sent from a verified Enterprise Angels emal address. If in doubt please call us.

Getting started in Early Stage Investing

The following guides are designed as an introduction to early stage investing, if you haven’t already read them, we encourage you to:

- Invest with Confidence: A beginners’ guide to investing in early stage businesses

- Enterprise Angels: Invest alongside New Zealand’s most experienced investors

- The importance of diversification: How investing in a fund can help

- The most rewarding investor network: A beginners’ guide to raising capital with angels

- Impact investing for Angels: A beginners’ guide to impact investing

- Due Diligence Checklist

For a deeper understanding of angel investing, how Enterprise Angels works and how to make the most your angel journey, Nina Le Lievre, our CEO, has pre-recorded an Express Angel 101 course. It is around 40 minutes so I’d recommend setting aside some time to watch it. View Express Angel 101 here.

Angel Association NZ (AANZ) also run regular educational events and an annual summit that you will receive invitations for. As a Enterprise Angels member you qualify for discounted membership rates when registering.

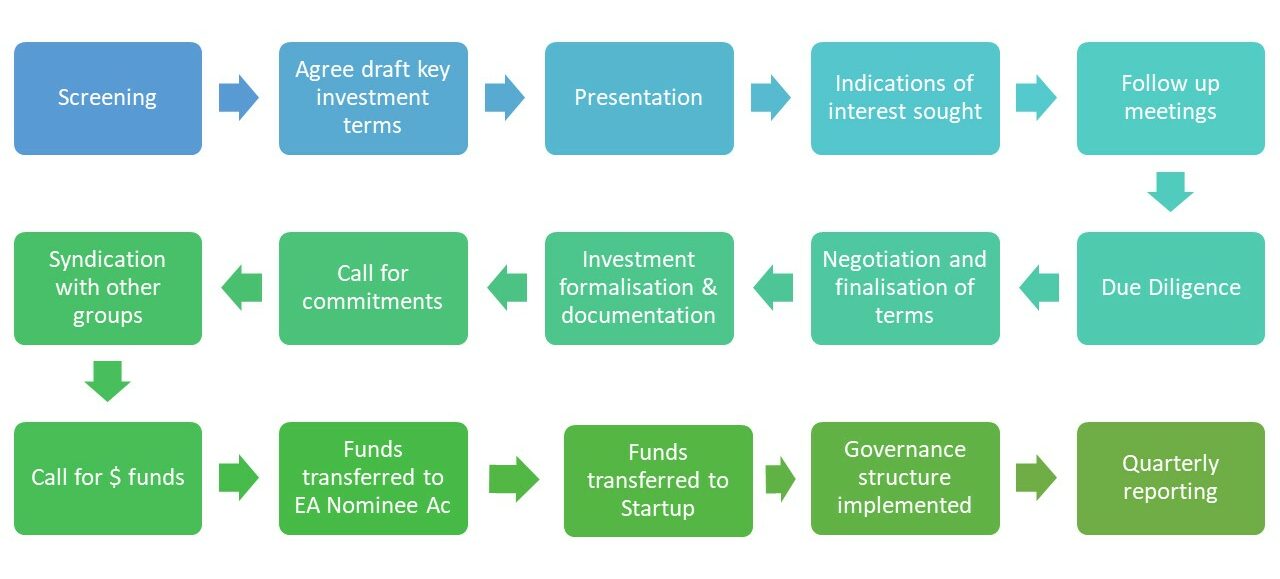

The Investment Process

To gain access to deal information on current opportunities you will need to access our Investor Portal and complete your wholesale investor certification.

Access to the portal was granted when you first joined but please contact us if you have not activated it yet and we will help you get the process started.

As a member you will be notified of deal opportunities and if interested you need to respond with a dollar value commitment by the required date. The minimum investment amount for members is $10,000 and for non-members $15,000. Members investment parcels vary from $10,000 – $100,000.

For your initial investment there will be some documentation required due to regulatory requirements. Once this is completed further investments will be a simpler process and you will be able to view all investment transactions, and documentation via the portal.

Click here for more information on the investor portal.

You will be notified of opportunities to purchase other members share units when they become available.

Fees

Enterprise Angels is funded by the fees we collect from our members, our partners and fees on investment transactions. You will be charged an admin fee upon investment along with an exit fee on divestment. These fees enable us to provide the functions of sourcing, reviewing, presenting and managing your investments. For a full schedule of our investment transaction fees, refer here.

For more information on fees we recommend you read the following blogs:

Investor Reporting and Shareholder Updates

Investor Reports are sent biannually in April and October.

You will receive shareholders updates from those companies you have directly invested. For Fund investors, company updates will be available with the Fund reports. For EA Fund 1 and EA Fund 2 these are sent on a six monthly basis in April and October. For EA Fund 3 and EA Fund 4 they will sent on a quarterly basis. An Annual report for each Fund will be released by the end of July.